Ethereum’s Home Staking: A Closer Look at the Elitist Efficiency

In this article, we continue our review of existing cryptocurrency mining technologies – Ethereum is next in line.

As the world of blockchain technology continues to evolve, Ethereum (ETH) stands at the forefront with its innovative consensus mechanism known as “home staking.” This concept, exclusive to Ethereum among staking options, involves users locking in a portion of their own ETH assets, transforming their nodes into validators. While celebrated for its energy efficiency, this system raises questions about elitism, akin to corporate workplace dynamics, and introduces potential security and maintenance challenges due to the integration of executable computer code, or smart contracts.

Efficiency in Energy, Elitism in Engagement

The process of home staking on Ethereum involves users locking in a significant amount of their ETH assets, typically around 32 ETH, to become a validator. While the Proof-of-stake (PoS) mechanism has been praised for its energy efficiency compared to traditional proof-of-work systems, the concentration of influence in the hands of those who can afford the blockchain sum raises concerns about the inclusivity of the Ethereum network. Conceptually, this can be likened to “paying for a workplace in a corporate environment to receive the possibility of future salary payments in ETH.” This approach, however, raises concerns about elitism within the Ethereum network, as only those who can afford to lock in such substantial amounts can participate in the staking process. This mirrors the centralized tendencies seen in other platform concepts over the past 50 years.

It may on the contrary reduce the security of the Ethereum blockchain and lead to its further centralization, as large market players, including various organizations and companies, will participate in the staking.

It is believed that after the transition to Proof-of-Stake, it will become easier for governments around the world to control Ethereum at the protocol level – they will be able to impose restrictions and rules on large organizations that hold large amounts of ETH. As a result, this could lead to censorship of ether transactions.

Centralization 2.0

Due to the cost and technical obstacles to creating an Ethereum node, a market of intermediary services from companies like Coinbase and “decentralized” collectives like Lido – allowing users to band together to collect 32 ETH for a node – has emerged. These intermediary organizations take on much of the heavy lifting: they accept ETH from users, stake it on their behalf, and receive a portion of the fees they earn from the validator’s work.

Staking could then increase the centralization of Ethereum, meaning that a small number of these intermediaries (or even one) could gain a disproportionate amount of control over what blocks are added to the network.

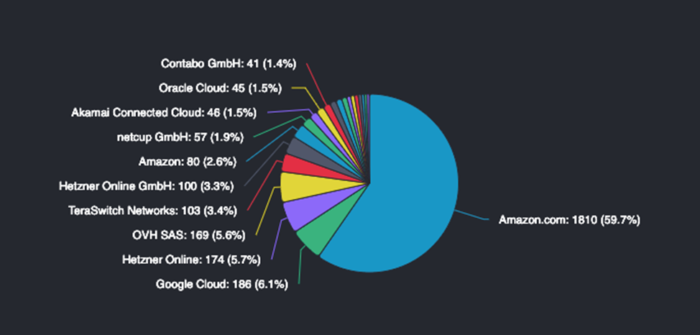

This scenario appears to be coming to fruition. Ethereum core network statistics show that the majority of nodes on the network are managed by centralized organizations – roughly 60% are served by Amazon Web Services (AWS) and 6% by Google Cloud. This means that AWS manages 1,810 nodes out of 5,901 active Ethereum nodes, while Google Cloud manages 186.

The centralization issue has raised concerns that the Ethereum blockchain faces a single point of failure problem. Some industry experts have also warned that Amazon founder Jeff Bezos could shut down decentralized Ethereum-based applications by simply shutting down AWS.

The Smart Contract Issues

One of Ethereum’s distinguishing features is its ability to execute smart contracts—self-executing contracts with terms written directly into code. However, the power of this feature comes with its own set of challenges. A significant percentage of Ethereum users may not fully comprehend the implications of storing executable code on a blockchain. From a scientific standpoint, the blending of the storage layer (blockchain) with business logic (smart contracts) raises concerns about security and maintenance, likened to a “huge security hole.”

Conclusion

While Ethereum’s home staking and smart contract capabilities have garnered widespread admiration for their diverse range of applications, it’s crucial to acknowledge the underlying issues. The elitist nature of home staking raises concerns about inclusivity within the Ethereum network, and the integration of smart contracts, while powerful, demands a meticulous approach to security and maintenance. As the world continues to embrace the versatility of web3 dApps in gaming, e-commerce, finance, and more, Ethereum must navigate these challenges to ensure a secure and inclusive future for blockchain technology.

THIS IS DIVA.EXCHANGE

The non-profit association diva.exchange, Switzerland, uses a barrier-free and collaborative approach to create free banking technology for everyone. Open-source technology ensures the privacy of all participants in the financial system of the future. The blockchain-based system is fully distributed. Everyone can participate in diva.exchange.

Diva.exchange is committed to the belief that only commercially free technology can reliably protect user privacy.

Collaboration with the scientific community plays an important role in the development of diva.exchange. The results of diva.exchange research are constantly being validated by academic institutions and publicly presented at specialized conferences.

LEARN MORE ABOUT OUR WORK

All technical information is available at: https://github.com/diva-exchange/

I2P beginner’s guide and installation guide:https://www.diva.exchange/en/privacy/introduction-to-i2p-your-own-internet-secure-private-and-free/

All videos are here: https://odysee.com/@diva.exchange:d/

Introduction to I2P: https://en.wikipedia.org/wiki/I2P

Testnet of diva.exchange: https://testnet.diva.exchange

CONTACT US

Twitter: https://twitter.com/@DigitalValueX

Mastodon: https://social.diva.exchange/@social

If you still have questions you can always find us on Telegram: https://t.me/diva_exchange_chat_de (in English, German, or Russian)